- S & P Downgrades Nigeria’s Outlook as Fitch Affirms Norway

By Hamilton Nwosa (Head, The New Diplomat Business & data tracking desk)

With escalating glut in oil supplies and stretched storage capabilities, exacerbated by Saudi Arabia increase in oil production even in the face of dwindling global demand, global energy experts have come up with grim outlook that the world may be heading towards Oil price crash as low as $17 per barrel in the coming weeks.

International demands for Oil have consistently shrunk in recent times following the outbreak of Covid-19 pandemic. Experts predict that the brief rebound in oil prices was premised on fluid dynamics that have since evaporated in an environment where international crude surplus has reached an all-time high.

For Nigeria, Africa’s most populous nation,whose externally generated revenue is about 97% dependent on earnings from crude oil, the grim outlook is compounded by the recent downgrading of Nigeria’s credit rating from stable to negative by Standard & Poor (S&P). The global rating agency cited Nigeria’s failing foreign-exchange reserves, slow GDP growth, rising public debt, multiple exchange rates and external pressures impacting its creditworthiness as basis for its latest rating.

According to S&P Global Market Intelligence report entitled “Sovereign ratings wrap: S&P Cuts Nigeria outlook; Fitch affirms Switzerland” Nigeria’s situation is in contrast with Norway whose long-and short-term foreign-and local-currency ratings were affirmed at AAA|F1+, “with a stable outlook, over its strong sovereign and external balance sheets, sustained twin surpluses, and sound policy institutions and macroeconomic policy framework.” Both Nigeria and Norway share a key similarity as oil producing countries.

With this latest development, experts say that all eyes are now on Nigeria’s Niger Delta, specifically the Delta creeks where influential de facto leader of the Niger Delta agitations, High Chief Government Oweizide Ekpemupolo aka Tompolo holds sway. An expert on crisis and conflict issues in Nigeria at the Chattham House, UK told The New Diplomat last night that as “ the global oil situation worsens with Nigeria’s domestic situation becoming very uncertain, all eyes are now on the Niger Delta especially Delta State which is Tompolo’s operational base as the acclaimed General Officer Commanding the Niger Delta agitation struggle.” He said: “ Any crisis in the creeks as at today would certainly worsen Nigeria’s situation, hence a pan-Niger Delta approach aimed at accommodating all stakeholders input working with the APC hierarchical political leadership in the South South since it’s the political party in power at the Federal level, is most crucial at this time. I’m not sure anyone can afford to expend funds on quelling agitations of any kind at this time or fixing blown up pipelines when government would be thinking how to source funds to pay workers’ salaries in the coming weeks. The Delta creeks is key now, more than ever before, because any activity that would further bring the Nigerian economy down should be avoided at all cost.”

Tompolo has gone underground since 2016 following a Federal High Court, Lagos bench warrant, which was issued on him, compelling the Economic and Financial Crimes Commission(EFCC) to lay a manhunt for him. High-level sources confided in The New Diplomat that a top player in the Buhari administration of Ijaw extraction, however, got assurances from Tompolo recently that he remains committed to preserving and maintaining peace in the Niger Delta in order to help save the nation’s fragile economy.

It was gathered that the intention of the meeting was to secure Tompolo’s assurances that Nigeria’s daily oil production would continue to run unhindered in order to avoid explosions with crippling effects on an already tough economy. Dr Paul Bebenimibo, spokesman for Tompolo was recently quoted as saying that the ex-militant who was in Gbaramatu Kingdom at some point in time has not stopped drawing government attention to his principles and peace-building views about the Niger Delta citing the visit of Vice President Yemi Osinbajo to Gbaramatu kingdom where Tompolo’s emissaries explained the later’s position on a wide range of issues about the Niger Delta to the Vice President.

Recall that the Federal government had recently revealed that Nigeria currently has about 50 cargoes of crude oil that have not found landing or off-takers due to increasing drop in demand. Managing Director of Nigeria National Petroleum Corporation (NNPC), Malam Mele Kyari who said this at a forum organized by the Central Bank of Nigeria(CBN) had disclosed that “ there are over 12 stranded LNG cargoes in the market globally. It has never happened before. LNG cargoes that are stranded with no hope of being purchased because there is abrupt collapse in demand associated with the outbreak of coronavirus.” Kyari painted an uncertain picture of the economic setting thus: “So, when the country’s crude oil is selling at $30 per barrel, and circumstances are forcing the country to drop the price by $8, it means in the market the country will be selling for $22 per barrel. That’s a massive problem. When crude oil price has gone down to $32 per barrel and you are producing at $30, you don’t need a soothsayer to tell you, you are out of business already.”

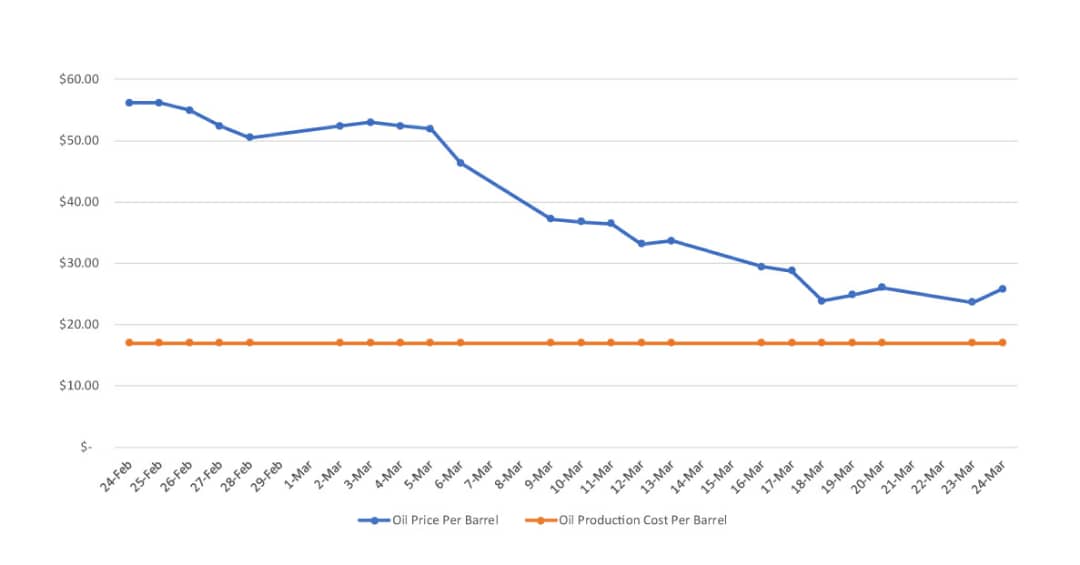

Kyari noted that given Covid-19 pandemic, Oil producing countries including Saudi Arabia are currently selling at $22 per barrel. According to him, when crude oil sells at $30 per barrel, “countries like Saudi Arabia is selling at $22 per barrel …” However, with Nigeria’s sad production cost standing at $17 a barrel(according to Kyari), the consequence is that should Nigeria emulate Saudi Arabia, the country would be earning only a marginal $5 on a barrel, a reality that has jolted many into realization that Nigeria’s relatively high production cost is unsustainable.Even more worrisome, data tracked from Knoema.com, a global oil data firm show that production cost in Nigeria’s Deepwater may be higher than $17 per barrel, as it ranges from $25 to $30 a barrel.

Miffed by this reality, sources hinted The New Diplomat that the Presidency and the leadership of the National Assembly are already stirring actions to ensure a drastic reduction in production cost. This according to the source would be in line with global standards, as well as international production algorithms in many other global jurisdictions. Said an insider: “It is something the National Assembly was already going to examine because the production cost is really too high. If it is not reduced, there will be no funds to even pay salaries in the long run…But for this Coronavirus, it would have been a major subject for deliberation at the National Assembly…”

Though the leadership of the National Assembly and the Presidency are in great synergy on the subject matter, and are both “ looking at reducing the high production cost”, The New Diplomat’s data show an un-pleasant down-ward reduction in Oil prices since February, 2020. The consequence is that the Delta creeks hold a major key to the future of Nigeria’s economy going forward.

Thomas Liles of Rystad Energy, a global energy consulting has this to say: “Compounding the situation is the near-certainty of a steep reduction in crude-by-rail exports this year, as well as deferral of spring maintenance at several key oil sands mining projects…the global oil industry may increasingly look to offshore oil tankers to store their extra crude oil, but for this to be economic it would require oil prices to fall further. The global oil price fell to lows of $25 a barrel as at last week, from more than $65 at the start of the year, and remains below $30 a barrel. That is why we have warned the industry that the oil price may fall to $10 a barrel this year.”

Paola Rodriguez-Masiu also of Rystad Consulting said: “ the world all over has about 7.2bn barrels of crude and products in storage, including 1.3bn to 1.4bn barrels onboard oil tankers at sea’’ adding that “ at the current storage filling rate, prices are destined to follow the same fate as they did in 1998, when Brent fell to an all-time low of less than $10 per barrel.” But some experts however posit that Rystad projections didn’t put some dynamics into consideration in arriving at its conclusion. One, the likelihood of Russia and Saudi Arabia returning to the negotiation table may restore oil price to normalcy, thereby boosting oil prices globally. Two, China is likely to return to normal Oil production facilities at the end of Covid-19. Analysts aver this has a likelihood of pushing up prices.

Minister of Finance’s Response: So Where Do We Go from Here?

Nigeria’s Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed says Nigeria may slide into recession if the Covid-19 continues unabated for the next six months. She added: “ We are hopeful that this pandemic will be limited in time. If the pandemic lasts three months or less, we should be able to close the year with positive growth. But if it goes longer than that-six months, one year-we will go into recession.” This is coming as S&P has already downgraded Nigeria’s rating even as the International Monetary Fund (IMF) admits that the global economy has already entered recession. Managing director of IMF, Kristalina Georgieva said no fewer than 80 countries have approached the IMF for financial help.

*Price projected to go even lower in the new week

For the NNPC’s GMD Nigerians should gear up for tougher days ahead with crashing crude Oil prices. The Federal government had in its response adjusted its 2020 budget estimates to align with current realities. Mrs Zainab Ahmed, said the federal government will implement a 50 per cent cut in revenue from privatization proceeds while announcing a drastic reduction in crude Oil benchmark price from its initial $57 to $30, with crude oil production remaining at 2.18m barrels per day.

For many stakeholders in the volatile Oil rich Delta, it is time to maintain peace with all key stakeholders and the political leadership of the South-South zone driving the process in a sincere, transparent, all-inclusive and accountable manner. According to stakeholders ‘’ this would help guarantee stable oil production, ensure peace in the volatile Delta where Tompolo wield so much influence, and help maintain and sustain existing production dynamics in order to preserve what is left of our already challenging national economy.”